How to set up Toridion Quantabotics

This tutorial shows you how to set up a Toridion Quantabotics and explains the settings you need to fill in.

Prerequisites

Before you begin, check the following:

- You have a Cryptohopper account

- You have a Toridion Quantabotics account

Set up a Tordion Quantabotic

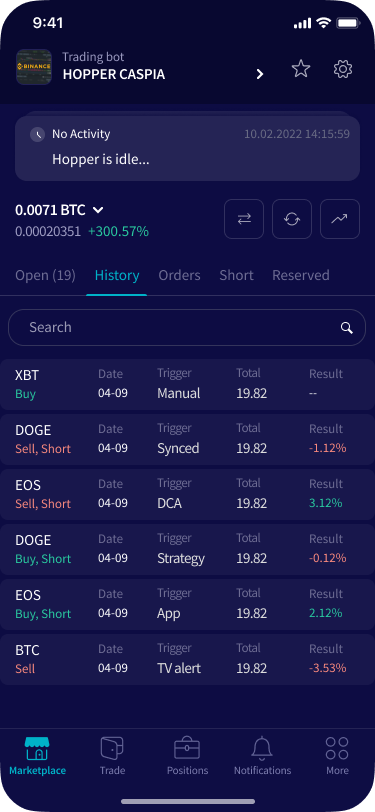

- Go to your Crypothopper account.

- Click “Marketplace”.

- Click “Apps”.

- Click “Quantabotics”.

- Login into Quantabotics.

- Choose if you want to set up a Switcher or the Volatility Protect.

- Fill in all the required fields.

- Click “Save Hopper Configuration”.

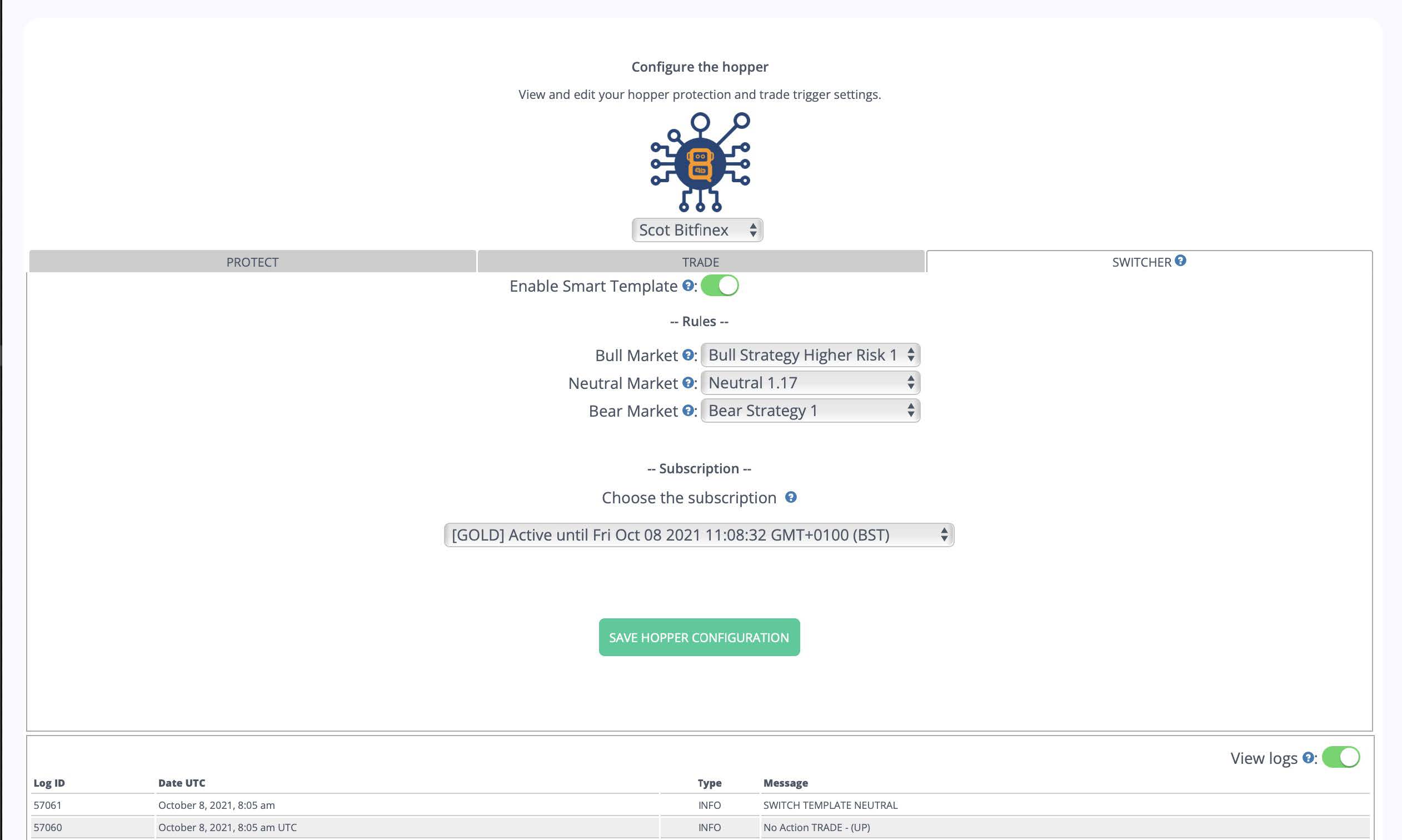

Settings the Template Switcher

Enable Smart Template

Switch the toggle so you can set up your Switcher.

Bull market

Select which Cryptohopper template you want to use for a bull market.

Neutral market

Select which Cryptohopper template you want to use for a neutral market.

Bear market

Select which Cryptohopper template you want to use for a bear market.

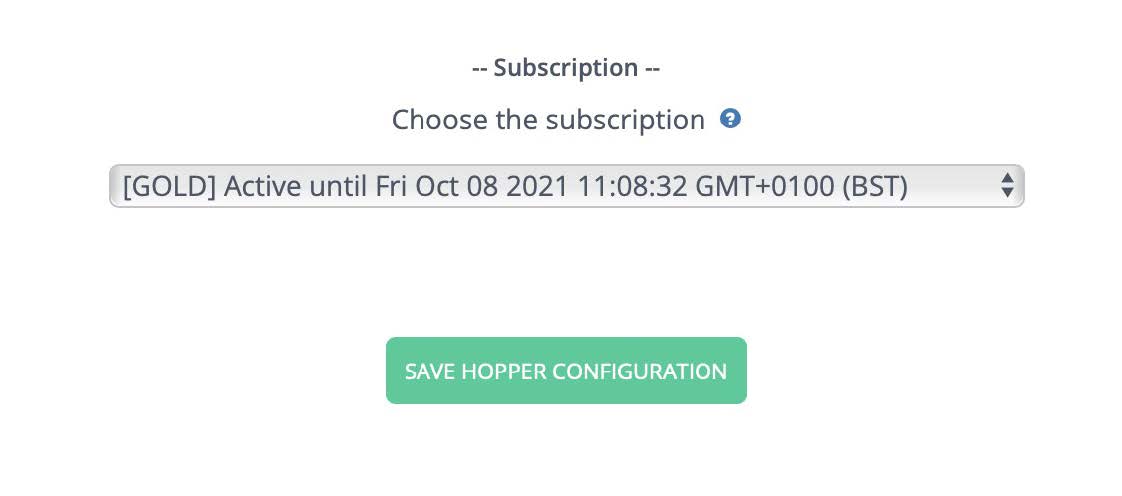

Choose the subscription

Select which subscription you want to use. Important: a Quantobot without a subscription will not send commands to your Cryptohopper bot. The Switcher bot only works with Switcher services. It will not work with the Volatility Protect.

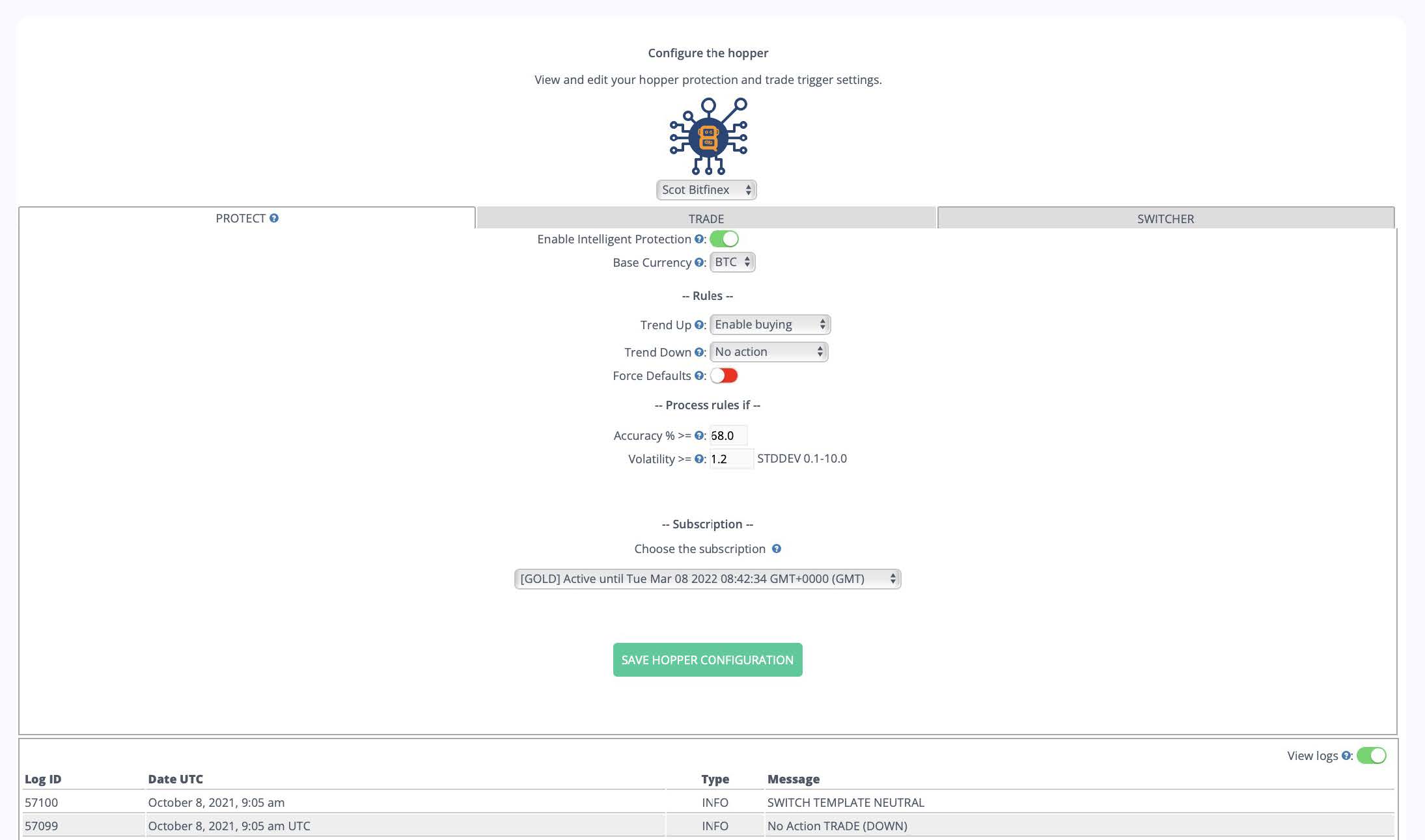

Settings Volatility Protect

Enable Intelligent Protection

Switch the toggle so you can set up your Volatility Protect.

Base Currency

Select the quote currency you want to use. The default is BTC.

Trend Up

Select what you want the trigger to do if the market if forecast to go up in the next hour. You can trigger 5 things:

- Do Nothing

- Open position

- Sell position

- Sell all

- Panic sell

Trend Down

Select what you want the trigger to do if the market if forecast to go down in the next hour. You can trigger 5 things:

- Do Nothing

- Open position

- Sell position

- Sell all

- Panic sell

Force Defaults

Switch the toggle so you tell the trigger to first enable buying and selling on your bot before processing the rules. If the trigger subsequently determines that the best course of action is to do nothing at all, the bots’ buy and sell will remain active.

Accuracy % >=

Fill in the minimum accuracy Toridion must have been achieving for the 24 hours immediately before processing the trigger rules. For example, if you enter 68% here and Toridion Finance calculates that it has been only 64% accurate in forecasting trend direction over the last 24 hours, the selected “action” will not be processed in this hour. This condition is used to decide if the “rule” has been met and therefore the “action” should be carried out.

Volatility >=

Fill in the minimum volatility that is required to process the trigger rules. For example, if you enter 1.2 and the volatility is calculated at 1.4 then the trigger will process the rules. This condition is used to decide if the “rule” has been met and therefore the “action” should be carried out.

Toridion Finance calculates volatility and price movement as a function of a 20-day standard deviation of hourly closing prices. If the standard deviation was determined to be $100, then 1.5 would mean a movement of $100*1.5=$150. By setting accuracy and volatility you have control over when you want to trust forecasts based on the historical performance of the markets.

Our API self-backtests using your requirements, you are instructing the API only to process a rule if it calculates its own accuracy of direction and volume forecasts for the last 24 hours and meets the levels you desire. The higher the accuracy you specify, the lower the volatility is likely to be, and therefore your bot may trade much less frequently at high-accuracy settings. The system defaults to 68% and 1.2 – 10 x deviation. Depending on the fees you pay on your chosen exchange, profit may not always be possible for an hourly position and you should use caution when choosing low volatility and accuracy settings try to prevent nonprofitable triggering of close or open positions.

Extra information

Auto Merge Positions Cryptohopper supports a function called “Auto Merge Positions” which will consolidate new orders into a single position with a single take profit value. This feature is very powerful and can simplify trading, but when used with Toridion data it can lead to many positions being opened when Toridion sends an SBI or BUY trigger. To simplify things Toridion has programmed Quantabots to respect (when possible) the Cryptohopper settings relating to the number of positions the user wishes to have open. Max Open Positions setting in your bot and Buy Settings is a sliding scale of 0-80. Before opening an order, your Quantabot will read this value and compare it to the number of currently open positions, and if there are fewer positions open than the Max Open Positions value the order will be placed. If you have “Auto Merge Positions” enabled, then you could have several past orders merged into a single position, and therefore always 1 position! Naturally, if the Max Open Positions setting is at 2 or more, then Quantabot will always think it is OK to open another position. Take care when using the Auto Merge feature and Quantabotics. Until you understand the settings and how they affect Quantabot's buying trigger, it is a good idea to set Max Open Positions to 1. This way you will not risk multiple buy orders merging into 1 position. The above is not an exhaustive review of the permutations of how Cryptohopper buy settings may affect Quantabotics BUY triggers. The most important point relates to the MAX OPEN POSITIONS value. Your Quantabot will simply count your open positions and compare to MAX OPEN POSITIONS. If the number of positions is less than this figure it will try to open a position if a BUY trigger is received.