Mastering Crypto Trading, The Importance of Take Profits and Stop Losses

Hey there, fellow crypto traders! Are you ready to level up your trading game and maximize your profits? If so, then it's time to talk about two essential tools in every trader's arsenal: take profits and stop losses.

These simple yet powerful techniques can make all the difference between success and failure in the volatile world of cryptocurrency trading. Let's dive in and explore why they're so important.

What Are Stop Losses and Take Profits?

First things first, let's define what take profits and stop losses are. Take profit orders allow you to set a predetermined price at which you want to automatically sell your asset and lock in your profits. On the other hand, stop loss orders allow you to set a price at which you want to automatically sell your asset to limit your losses.

Now, you might be wondering why these tools are so crucial. Well, let me tell you, they're like your best friends in the crypto market, always looking out for your best interests. Here's why:

Protecting Your Profits: Take profit orders ensure that you don't get greedy and hold onto a winning position for too long, only to watch your profits evaporate when the market suddenly reverses. By setting a target price to take profits, you can lock in your gains and avoid the temptation to hold on for even bigger gains, which may never materialize.

Limiting Your Losses: Stop loss orders, on the other hand, act as a safety net to protect your capital in case the market moves against you. They allow you to define your risk tolerance and set a maximum loss that you're willing to accept on a trade. This is especially important in the highly volatile world of cryptocurrencies, where prices can swing wildly in a matter of minutes.

Implementing Stop Losses and Take Profits on Cryptohopper

Let's examine an example demonstrating how employing a stop loss and take profit enhances the effectiveness of your strategy.

Moreover, for simplicity, we will focus solely on a single cryptocurrency: Bitcoin (BTC).

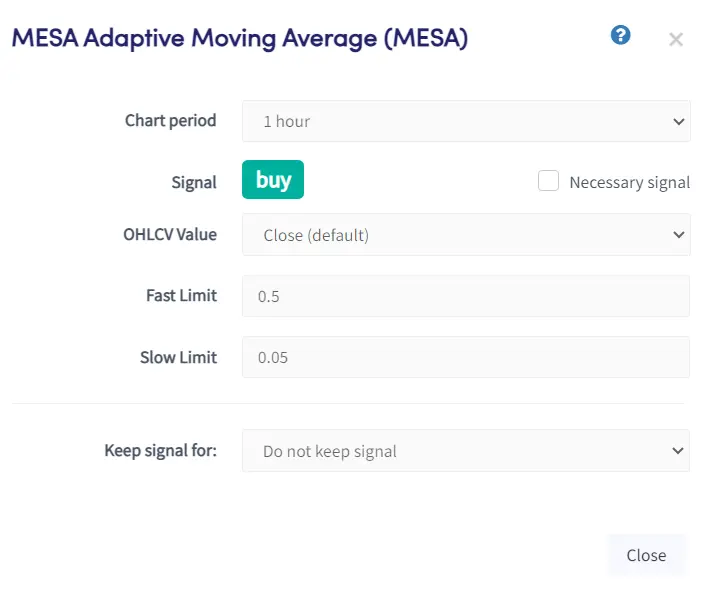

In this strategy, we will utilize a trend-following indicator on the hourly chart, specifically the MESA. If you're unfamiliar with trend-following indicators, we recommend reading our article on them.

In essence, the MESA is a trend-following indicator that continuously generates buy signals when the MAMA remains above the FAMA. Conversely, it generates sell signals as long as the MAMA is below the FAMA.

We will leave the MESA with its default settings for this example (except for the Chart period which is changed to 1 hour), as our focus lies on the take-profit and stop loss, rather than on the indicator itself.

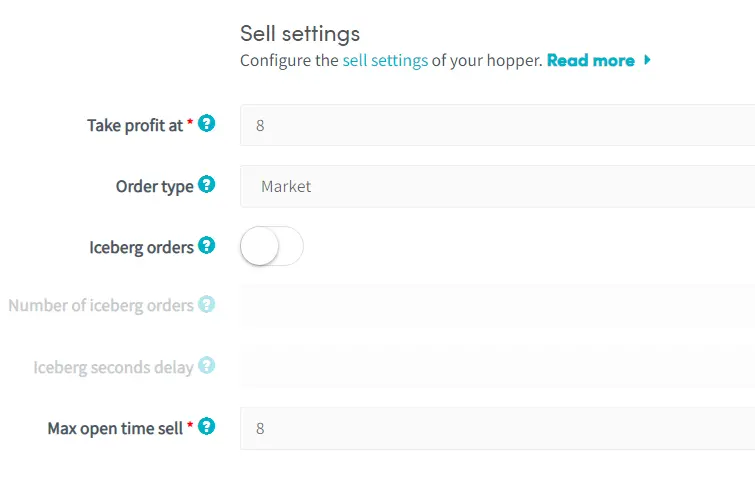

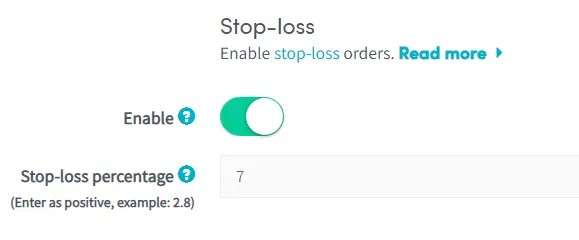

In our example, we can utilize the MESA to initiate a long position and then employ either the take-profit or stop loss (whichever activates first) to close that position. In this instance, we will set a take-profit of 8% and a stop-loss of 7%.

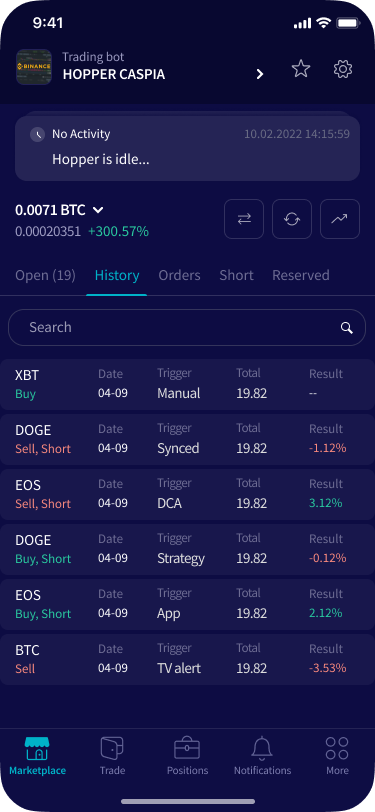

If you had employed such a strategy from September 2021 until April 2024, considering a 0.1% fee and entering all positions with the entire portfolio, you would have achieved a 218% profit. In contrast, the buy-and-hold approach for the same period resulted in just a 91% profit, indicating that the strategy performed over two times better.

On the other hand, if you had solely relied on the MESA to open and close trades, your profit would have been only 64%, even worse than the buy-and-hold strategy. Thus, in certain cases, utilizing take-profit and stop-loss can outperform exits provided by technical indicators.

Nonetheless, it is crucial to thoroughly backtest your strategy, particularly on the specific cryptocurrencies you plan to trade, as this isn't universally applicable. There are instances where implementing a take-profit and stop-loss instead of relying solely on technical indicators for closing positions can prove detrimental. Therefore, testing it extensively on your unique strategy and chosen cryptocurrency is imperative.

Here's how you can incorporate the MESA on Cryptohopper:

Next, you can include the take-profit in Config/Baseconfig:

Lastly, you can integrate the stop-loss like this:

Bottom Line

Incorporating stop-loss and take-profit orders alongside trend-following indicators like MESA can substantially enhance trading effectiveness. The example provided illustrates significant profit increases compared to buy-and-hold or indicator-only strategies. However, thorough backtesting is essential, as effectiveness is based on market conditions and each cryptocurrency individualy. In cryptocurrency trading, active risk management and strategy refinement are key to maximizing returns.